How are stock options taxed in Sweden? (eng)

This article will guide you through options as an incentive tool in Sweden. For more general information regarding options as an incentive in a global context, please see our international website: www.optionspartner.com

A general background to options

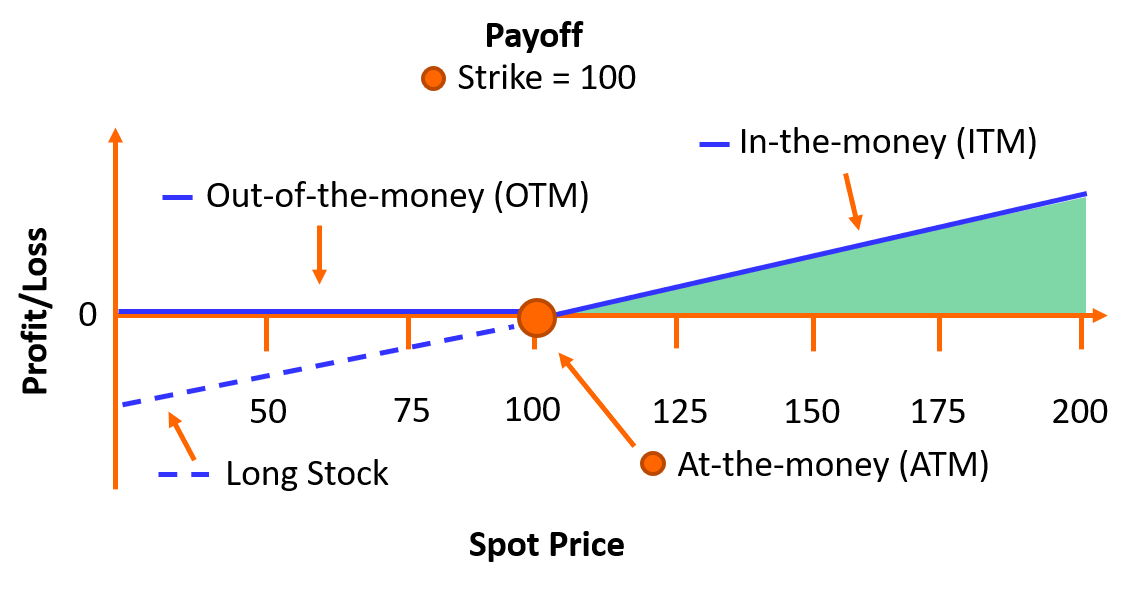

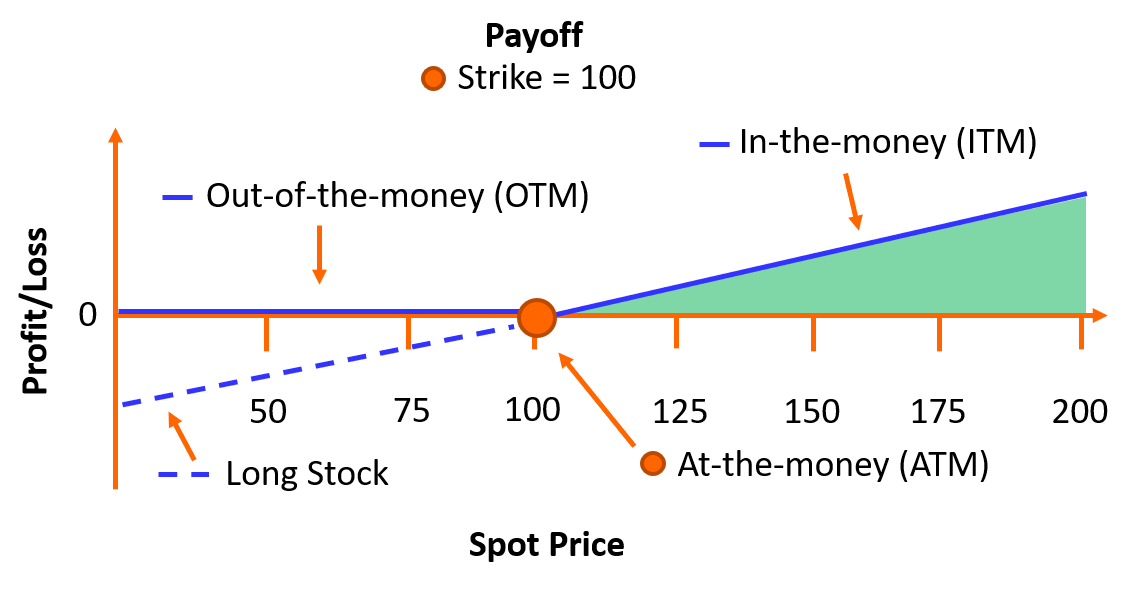

An option is a financial instrument that distributes the value development of an underlying asset between the issuer and the holder, ie the buyer of the instrument. In incentive programs, options are used that give the holder the right to the value above a threshold, the ”exercise price” or ”strike price”.

The advantage of options instead of shares in incentive programs is that the option can detach ownership from the compensation. This means that you can design an option program or plan so that the participants can take part in the value development without eventually becoming shareholders. In companies with high staff turnover, option programs enable freedom of action for original owners.

Different types of options in Sweden

Common to all reward systems is that they create incentives for key people to focus on the company’s value development. There are different types of options for different needs:

Stock Options (or Employee Stock Options Plan, i.e. ESOP, sv. Personaloptioner) works as an employment-related benefit. The Swedish Tax Agency’s name Personaloption (swedish term) refers to a right to purchase a share at a predetermined price in the future. The option is closely associated with an employment, cannot be transferred and is often obtained without any premium being paid.

Call options (sv. köpoptioner) are options on existing shares. They are considered as securities for tax purposes, given that they can be transferred and are not linked to employment. Call options are advantageous if there is a sole owner of the company. For example, if a parent company wishes to create incentives for the management of a subsidiary. Call options are relatively easy to handle administratively.

Synthetic options (or Phantom in some jurisdictions, sv. Syntetiska optioner) do not give the right to buy securities, but instead the right to receive a share of the value development of the underlying securities. The holder therefore does not become the owner of securities. Synthetic options are suitable if you do not want the holder to become an owner.

Warrants (sv. Teckningsoptioner) refer to the issue of new shares in contrast to ordinary call options. Because they are associated with a future new share issue in the company, they are more complicated to handle administratively. Warrants are suitable if there are several owners of the company.

Taxation of options

Stock Options are taxed in connection with the underlying share being acquired by the employee. In other words, when the option is issued, there is no taxation of the employee (at grant). Upon redemption (or exercise), a salary benefit arises. This is because the exercise price for the shares is usually below the market value. If not, the option holder would probably not have bought the shares. Such a benefit is taxed. Social security contributions are paid by the company.

Qualified Stock Options (”QSO” or sv. ”Kvalficerade Personaloptioner” or ”KPO”) are options with a new tax status and is special type of stock option that meets the requirements of section 11a in the Swedish Income Tax Act). The new rules were introduced in 2018. They are not taxed when the option is issued/granted or when the underlying share is acquired by the employee. Instead, any gain on the sale of the share is taxed in connection with the sale. It may then be relevant with the small business rules. Qualified Stock Options are determined by the terms of the company, the stock option and the employee.

For Call Options and Warrants which are regarded as securities (in Sweden), benefit taxation takes place already when the option is issued. If the fair market price is paid at the time of acquisition of the options, no benefits will arise at exercise. The value development of the option is taxed as capital income, if it were to be sold. If the option is exercised to purchase the underlying share, the premium paid for the option is added to the share’s acquisition value. Note that the small business rules may be applicable when taxing both the sale of the option and the share.

Example – Option program for the CEO ”hard-working” Lisa

The company wants to create an option plan for key employees. The company’s share is worth SEK 100. The companies and their owners wish to issue options with the right to subscribe for new shares in 3 years for SEK 100 each.

Diligent Lisa who is a key person and CEO likes the opportunity. At year 3, the company’s share is worth SEK 500.

Below we list three different examples. The first two, ”Stock options” and ”Qualified Stock Options” are options that are not securities but give the right to acquire securities in the future. The last example is ”Warrants” and is an option that qualify as security.

Stock Options

Value

Payment for Option

Value per Share (Today)

Exercise (at year 3)

Value per Share year 3

SEK 400 benefit for employee

social security contributions of approximately SEK 125 will be added

Qualified Stock Options

Value

Payment for Option

Value per Share (Today)

Exercise (at year 3)

Value per Share year 3

SEK 400 unrealized profit

Warrants

Value

Payment for Option

Value per Share (Today)

Exercise (at year 3)

Value per Share year 3

SEK 400 unrealized profit

We can assist you

Option partners always offer advice to our clients regarding the design of option programs in the best possible way from a tax point of view. Note that special rules apply to small businesses.

Read more on:

Gratis optionsvärdering

Sätt pris på din option! Enkelt verktyg, utan kostnad. Läs mer (på engelska) …

Kontakta oss

tel 073-413 88 50 eller